Let’s be honest—managing the finances of a remote-first company is a whole different ballgame. It’s not just about taking your old spreadsheet and moving it to the cloud. You’re dealing with a workforce scattered across time zones, a patchwork of local tax laws, and expenses that pop up in a dozen different currencies. The old playbook? It’s kinda out the window.

But here’s the deal: when you get it right, the payoff is huge. You unlock efficiency, build incredible trust with a distributed team, and create a financial engine that’s as agile as your work culture. This guide dives into the unique challenges—and frankly, the opportunities—of financial management for distributed companies. We’ll talk strategy, tools, and the mindset shift you need to make.

The Core Financial Challenges of a Distributed Model

First, let’s name the beasts you’re dealing with. It’s more than just “people aren’t in the office.” The financial infrastructure itself gets stretched.

1. The Multi-Jurisdictional Maze

You know this one. An employee in Lisbon, a contractor in Manila, and an LLC registered in Delaware. Each location comes with its own rules for payroll taxes, benefits requirements, and invoicing regulations. Misstep here, and you’re facing penalties, back taxes, or even legal headaches. It’s a constant, low-grade hum of complexity.

2. Expense Management Gone Global

Remember the simple office supply run? Now it’s a co-working day pass in Bogotá, a home internet reimbursement in Warsaw, and a software subscription billed in GBP. Tracking, approving, and reconciling these expenses—across currencies and with proper receipts—can swallow up your finance team’s week. Without a clear policy, ambiguity breeds frustration… and sometimes, let’s be real, questionable spending.

3. Cash Flow Visibility (or the Lack Thereof)

When operations are invisible, happening in living rooms and coffee shops worldwide, financial visibility can feel foggy. You need real-time insight into burn rate, accounts payable/receivable, and cash position. Relying on monthly manual reports is like driving a speedboat by looking at last week’s map. You’ll miss the rocks.

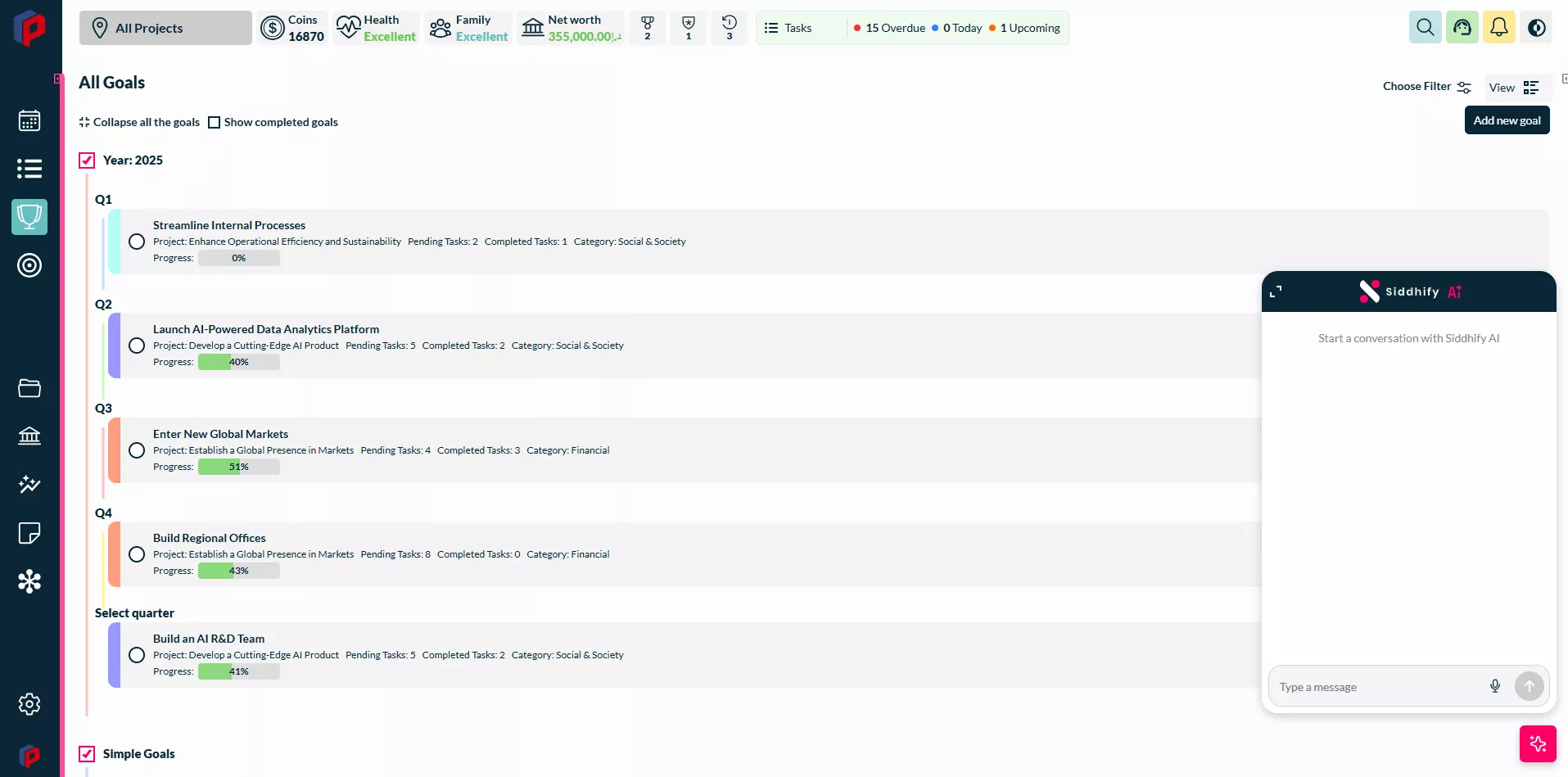

Building Your Remote-First Financial Stack

Okay, so the challenges are clear. The solution isn’t a single magic tool, but a connected stack—a set of integrated systems that automate the grunt work. Think of it as the central nervous system for your company’s finances.

| Function | Tool Examples & Purpose | Key Consideration for Remote |

| Core Accounting | QuickBooks Online, Xero, NetSuite | Cloud-native, multi-currency support, role-based access. |

| Payroll & Compliance | Deel, Remote, Rippling | Handles EOR/PEO needs, local tax filings, global contractor payments. |

| Expense Management | Brex, Spendesk, Ramp | Virtual/physical cards, automated receipt capture, policy enforcement. |

| Payments & Invoicing | Stripe, Wise, PayPal | Low-cost international transfers, professional multi-currency invoices. |

| Financial Planning (FP&A) | Adaptive Insights, Anaplan | Real-time dashboards, scenario modeling for dynamic planning. |

The goal is integration. You want your expense tool to talk to your accounting software, and your payroll data to flow seamlessly into your FP&A platform. This eliminates manual data entry—a huge source of error—and gives you that single source of truth.

Cultivating a Culture of Financial Transparency

This might be the most important part. Tools are useless without trust. In a remote setting, you can’t overhear conversations or see body language in budget meetings. You have to over-communicate finances deliberately.

How? Share key metrics regularly in company-wide calls. Democratize budget access (within reason) so team leads feel ownership. Explain the “why” behind spending freezes or investments. When people understand the financial heartbeat of the company, they make smarter, more aligned decisions—no matter where they’re logging in from.

Policy as Your Foundation

A clear, written expense and reimbursement policy is non-negotiable. It should cover:

- What’s reimbursable: Home office stipend? Yes. Ergonomic chair? Maybe. A new gaming headset? Probably not. Spell it out.

- The process: Submit within X days, use this app, provide this type of receipt. Make it stupidly simple.

- Approval workflows: Who approves what, and what’s the SLA for approval? Clarity prevents bottlenecks.

Strategic Considerations: Beyond the Basics

Once the engine is running, you can start thinking strategically. Here’s where remote-first finance gets interesting.

Compensation Philosophy: Will you pay San Francisco rates everywhere, use a location-based calculator, or something in between? This is a massive decision impacting talent, culture, and your burn rate. There’s no one right answer, but you must have a deliberate, equitable philosophy and stick to it.

The Contractor vs. Employee Dilemma: It’s tempting to hire contractors globally for flexibility. But misclassification risk is real. Using an Employer of Record (EOR) service can give you the flexibility to hire employees legally almost anywhere, often a smarter long-term play for core roles.

Cybersecurity & Fraud Prevention: A distributed team means distributed endpoints. Strong financial controls—like multi-signature approvals for large transfers, mandatory VPN use, and regular audits—are your moat. Don’t skimp here.

Wrapping Up: The Bottom Line

Financial management for a remote-first company isn’t just an administrative task. Honestly, it’s a core strategic function. It’s the framework that allows your distributed model to thrive—or the friction that grinds it to a halt.

The shift requires investment. In the right tech stack, in clear policies, and most of all, in a culture of radical transparency. But the result is worth it: a resilient, scalable, and truly global operation. You build a business that’s not limited by geography, but empowered by it. And your finance function? It stops being a back-office cost center and becomes a genuine enabler of growth. That’s the real opportunity hiding in all this complexity.